Update on 2023 Hospital Finances

In June of 2023, I wrote about how the financial results of US hospitals were bleak. According to the latest Kaufman Hall Flash Report, operating margin averaged just 0.7% back in June. That was good news at the time, because it was the third month in a row that operating margins were positive.

The View Six Month Later

So how do things look now that we've put 2023 behind us? We don't yet have the full year's data, but the trends remain positive. Here is a quick summary based on the most recent report issued by Kauffman Hall at the end of November.

Margins have flattened at just slightly above 1% for the last 5 months. This is a positive development given they were consistently negative for the prior year. However, this is much below the historical operating margin average of about 6% (source: S&P).

Average operating margin for US hospital, from National Hospital Flash Report: November 2023, Kauffman Hall (published November 28, 2023)

The trend in outpatient business growth continued. Inpatient revenue year to date has grown 3% versus the same total for 2022, while outpatient revenue has grown 11% year to date versus 2022.

Labor expenses are still growing, but at a typical inflationary rate of 2% more than in 2022 for this same month. This is a bit misleading as a metric since overall labor is about 20% higher than 2020 levels. Total expenses year to date, including labor, supplies, and drugs are 3% higher vs. a year ago, with supplies growing at 5% and drugs at 0%. Again, while this sounds like a typical inflationary amount, total expenses are 20% higher than in 2020.

What does this mean for hospital profits?

In my prior post I wrote about the financial results from HCA and Tenet who seem to benefit from the growth in ambulatory service revenue. A recent article from Becker's lists the financial results for a select group of US hospital systems, using the recently reported annual data. As you might expect, HCA and Tenet are leaders in operating margin given their size and investment strategy. However, viewing the results we see how deceptive "average" operating margins can be given the spread in the industry.

In the group of hospitals in the above figure, the average operating margin is 1.2%, which equals the Kaufman Hall metric for US hospitals. In my analysis, which eliminated the two non-operating figures reported by Becker's, the spread was +11.1% to -5.5% for operating margin. We see a number of hospital systems near or above the historic average of around 6%, but a majority below it.

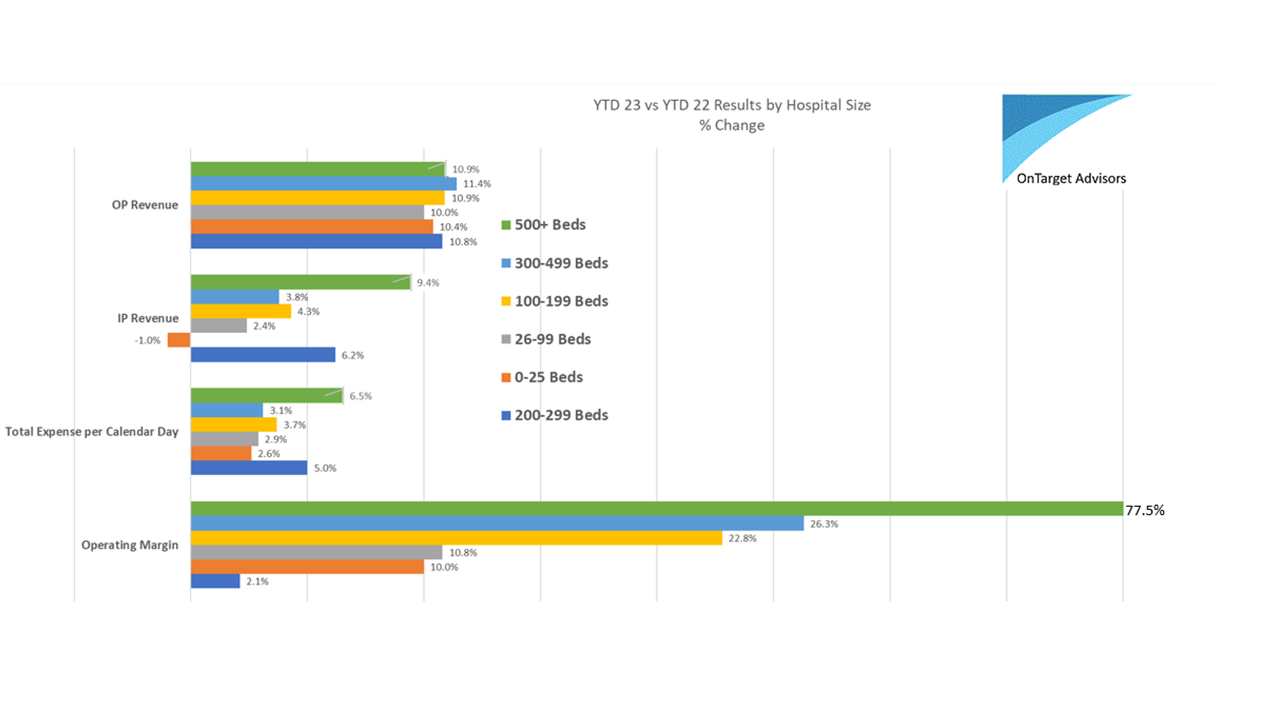

As a way to drill into the data to reveal more insights beyond broad averages, let's look at the results by hospital size as measured by the number of licensed beds.

Results of hospital operations by hospital size as reported by Kaufman Hall. IP is inpatient, and OP is outpatient results. These figures are percent changes year-to-date for 2023 compared to 2022 and not absolute values.

When looking at operating results for 2023 year-to-date compared to 2022 for the same period, we see:

Margins increase with size of hospital. Larger hospitals treat more complex cases given their role as regional referral hubs. This is seen in the revenue differences Inpatient revenue has grown more for larger hospitals than smaller ones. In HCA's recent earnings call, they emphasize how their revenue flywheel is driven by their clinics and rural small hospitals that feed the large urban hubs.

Growth in expenses are about the same, except very large hospitals (500+) and 200-299 beds. This may be related to the very large hospitals are placed in urban centers with the highest cost of labor.

Outpatient revenue grew much faster compared to inpatient revenue across all sizes. However the largest hospitals saw almost equal growth for both.

2023 is shaping up to be a good year for the large hospitals that serve as a regional referral centers. While expenses are growing faster that other segments, their ability to drive efficiency is doing well for margins. This is only sustainable as long as they can keep patients flowing into their system, which is being challenged by the battle for consumers and employer health plans via primary care. That is a topic for another day.